Hidden retirement costs: 6 unexpected expenses for retirees

By Jason R. Friday, CFP®, MPAS®, RICP®, CMFC, Head of Financial Planning | Citizens Wealth Management

As Head of Financial Planning, Jason is a strategic partner who is responsible for developing the strategy, managing the planner teams, and coordinating personal financial planning activities across Citizens Wealth Management to help clients navigate and grow in changing circumstances.

Key takeaways

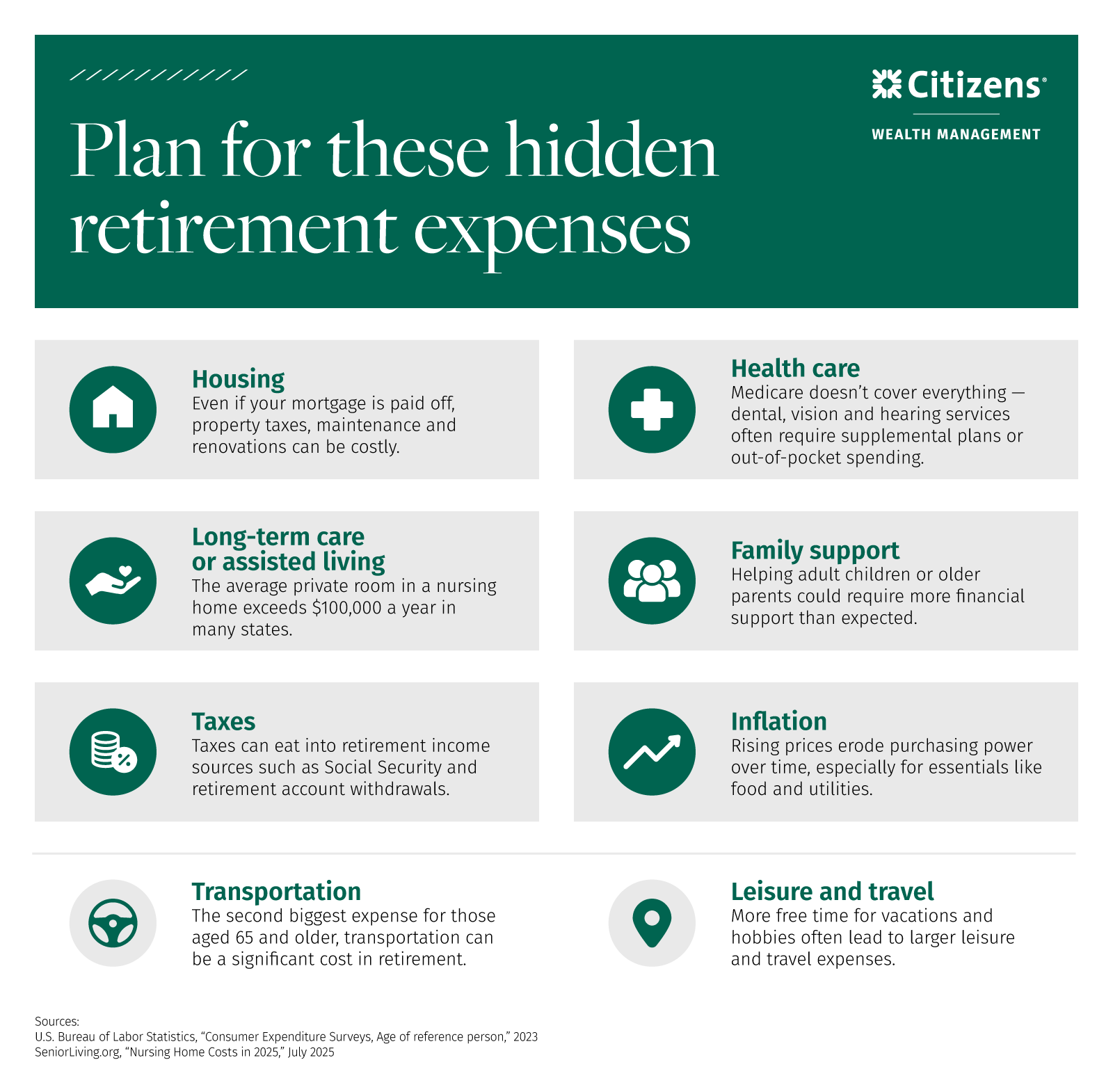

- Retirees are often surprised by the costs of homeownership, health care and taxes in retirement.

- The cost of maintaining your retirement lifestyle is higher than most people expect due to the impact of inflation over time.

- A strong retirement plan addresses both the obvious and often-overlooked expenses that can cut into your retirement budget.

Retirement can be one of the most fulfilling chapters of life, but it's also one that's financially complex.

The decades of careful planning that go into saving for retirement don't end when you stop working. Instead, a new set of financial challenges emerges, including navigating retirement costs that can reduce funds quickly, especially if they're unexpected.

Whether you are planning for your future or already retired, here are six hidden retirement costs to factor into your retirement plan and budget.

1. Housing costs beyond the mortgage

While it's a common goal to retire mortgage-free, housing costs don't disappear once the loan is paid off. Adults aged 65 and older spent an average of $21,445 per year on housing despite the fact that 53% are homeowners with no mortgage.1 Housing remains their largest expense and accounts for about one-third of their total spending.

Even without a mortgage, retirees still face significant costs like property taxes, homeowners insurance, utilities and ongoing maintenance. Additionally, retirees may need to pay for home renovations or modifications to accommodate aging in place, such as installing ramps, grab bars or walk-in bathtubs. For those planning to relocate or downsize, moving expenses can add up quickly.

For these reasons, housing remains a major, yet often underestimated, cost in retirement.

2. Health care costs

Health care is another big expense for retirees. The aged 65 and older segment spent an average of $8,027 on health care, making it their third largest expense category.1

Many retirees assume Medicare will cover most medical costs. While it provides a solid foundation, it doesn’t cover everything. Gaps in coverage can lead to significant out-of-pocket costs. Here’s what to consider:

- Original Medicare (Parts A and B): This includes hospital insurance (Part A) and medical insurance (Part B), however you are still responsible for deductibles, coinsurance, copayments, and services that are not covered, such as dental, vision, and hearing. In 2025, Part B premiums start at $185 per month, while Part A is typically premium-free.2

- Supplemental coverage: To help manage costs, you could purchase additional plans. Medicare Part D insurance plans provide coverage for prescription drugs with an average premium of $46.50 per month.3 Medigap plans sold by private insurance companies can help cover the out-of-pocket expenses in Original Medicare. Prices vary widely depending on the insurance company, plan, and your location.

- Other options: Medicare Advantage plans, also sold by private insurance companies, bundle Parts A and B, typically include Part D, and may offer extra benefits such as dental, vision or hearing coverage. Alternatively, Health Savings Accounts (HSAs), if funded during working years, can be used tax-free for qualified medical expenses in retirement.

Understanding what Medicare does and does not cover can help you make the right decisions about supplemental plans.

3. Long-term care

Medicare and most health insurance plans do not cover long-term care services like nursing homes or assisted living.

According to the U.S. Department of Health and Human Services, nearly 70% of 65-year-olds will need long-term care at some point in their life, typically lasting around three years.4 The average nursing home in the U.S. exceeds $100,000 per year.5

Given the high costs of long-term care, it’s essential to plan ahead by exploring long-term care insurance, setting aside savings for future care needs, or a combination of both.

4. Financial support for family members

Many retirees provide ongoing financial support to help their loved ones. This could include helping an adult child with a down payment, covering daycare or education expenses for grandchildren, or assisting an older parent with medical expenses.

While the level of support varies, the trend is common. An AARP survey found that 44% of parents provide as much or more financial support to their adult children than their own parents did.6 Another survey found that 55% of adults say they feel a strong sense of responsibility to provide financial assistance to elderly parents.7

The desire to help is natural, but the key is to strike the right balance. Without a clear plan, generous giving could jeopardize your own retirement. Be open with family members about your financial boundaries, and consider non-monetary ways to help them too, such as offering time, guidance, or shared resources.

5. Taxes on retirement income

You might expect that you no longer have to pay income taxes after you stop working, but that's usually not the case.

Distributions from traditional individual retirement accounts (IRAs) and 401(k)s are taxed as ordinary income. Depending on your combined income, up to 85% of your Social Security benefits may be taxable. Income from pensions or other investments can further increase your tax liability.

For those with a traditional IRA or 401(k), you can delay withdrawals to help manage your tax burden. However, starting at age 73 you must make required minimum distributions (RMDs), which could push you into a higher tax bracket. Missing an RMD can result in a tax penalty based on the amount you failed to withdraw.

Tax-efficient planning is critical in retirement. Strategies like Roth conversions, qualified charitable donations (QCDs), and managing the withdrawal sequencing can help manage taxes while preserving wealth over time.

6. Inflation and its impact over time

The inflation rate is a measurement of the annual percentage change of the price of goods and services. Over time, inflation quietly erodes purchasing power.

Even at a moderate historical average of around 3% per year, the cost of essentials — such as food, utilities, and health care — can more than double over a 25-year retirement. Periods of high inflation, such as 2021 and 2022 when the U.S. inflation rate hit 7% and 6.5%, can accelerate that process.

To help safeguard your lifestyle, it’s important to build a retirement plan that anticipates rising costs. A diversified portfolio that includes assets with the potential to outpace inflation could help preserve purchasing power and support long-term financial stability.

Other notable retirement expenses

Beyond the usual categories, here are a few other expenses that can surprise retirees:

- Transportation: While transportation costs are expected, the amount may be surprising. At $9,033 per year on average, it’s the second largest expense category for the aged 65 and older group.8 Fuel, auto insurance, maintenance and monthly payments for a new vehicle are important expenses to take into consideration.

- Leisure activities and vacation: With more free time, many retirees find themselves traveling or engaging in leisure activities more often. Depending on your lifestyle and priorities, these costs can vary widely and should be thoughtfully integrated into your retirement plan.

Plan for hidden retirement costs

The financial demands of retirement are higher and more complex than most retirees expect. Whether you are years away from retiring or already enjoying it, now is the time to evaluate your financial picture and prepare for what’s ahead.

By understanding your lifestyle and goals, a Citizens Wealth Advisor* can help you build a personalized retirement plan that accounts for both the expected and unexpected turns in life. The right plan today can provide financial confidence for decades to come so you can enjoy retirement to the fullest.

Related topics

Strategies to catch up on your retirement savings

If you’re feeling behind on your retirement savings, there are strategies that could help you make up for lost time.

How much do you need to retire?

While there is no one-size-fits-all plan, here are some common guidelines and benchmarks for determining your retirement savings amount.

Top retirement risks and how to prepare for them

Learn how to prepare for common retirement risks to help secure your financial future.

© Citizens Financial Group, Inc. All rights reserved. Citizens is a brand name of Citizens Bank, N.A. Member FDIC

1 BLS, "Consumer Expenditure Surveys, Age of reference person," 2023

2 Medicare.gov, "Medicare Costs"

3 CMS.gov, "Medicare Advantage and Medicare Prescription Drug Programs to Remain Stable as CMS Implements Improvements to the Programs in 2025," Sept. 2024

4 Department of Health and Human Services, "How much care will you need?"

5 SeniorLiving.org, "Nursing Home Costs in 2025," July 2025

6 AARP, "Parenting Later and Longer Impacts Parents 50-Plus," June 2024

7 Pew Research Center, "Public has mixed views on the modern family, 4. Family responsibilities, " Sept. 2023

8 BLS, "Consumer Expenditure Surveys, Age of reference person," 2023

* Securities, Insurance Products and Investment Advisory Services offered through Citizens Wealth Management.

Disclaimer: Citizens Securities, Inc. and Clarfeld Financial Advisors, LLC do not provide legal or tax advice. The information contained herein is for informational purposes only as a service to the public and is not legal advice or a substitute for legal counsel. You should do your own research and/or contact your own legal or tax advisor for assistance with questions you may have on the information contained herein.

Banking products are offered through Citizens Bank, N.A. ("CBNA"). For deposit products, Member FDIC.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the U.S., which it authorizes use of, by individuals who successfully complete CFP Board's initial and ongoing certification requirements.

All investing involves risk, including the risk of loss of principal. Investment risk exists with equity, fixed income, and other marketable securities. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

Citizens Wealth Management (in certain instances DBA Citizens Private Wealth) is a division of Citizens Bank, N.A. ("Citizens"). Securities, insurance, brokerage services, and investment advisory services offered by Citizens Securities, Inc. ("CSI"), a registered broker-dealer and SEC registered investment adviser - Member FINRA/SIPC. Investment advisory services may also be offered by Clarfeld Financial Advisors, LLC ("CFA"), an SEC registered investment adviser, or by unaffiliated members of FINRA and SIPC providing brokerage and custody services to CFA clients (see Form ADV for details). Insurance products may also be offered by Estate Preservation Services, LLC ("EPS") or an unaffiliated party. CSI, CFA and EPS are affiliates of Citizens. Banking products and trust services offered by Citizens.

SECURITIES, INVESTMENTS AND INSURANCE PRODUCTS ARE SUBJECT TO RISK, INCLUDING PRINCIPAL AMOUNT INVESTED, AND ARE:

· NOT FDIC INSURED · NOT BANK GUARANTEED · NOT A DEPOSIT · NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY · MAY LOSE VALUE